- By Todd Luck

- Posted Monday, February 3, 2020

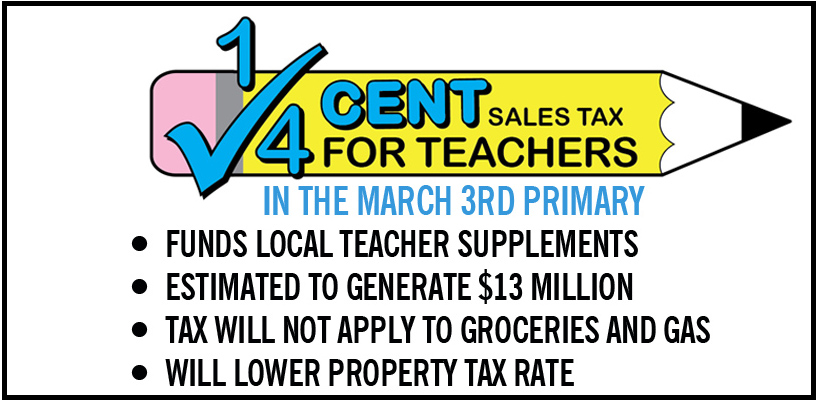

New website provides information on ¼ cent sales tax for teachers

Voters will be weighing in on a ¼ cent county sales that is estimated to bring in more than $13 million for teacher supplements during the March 3 primary.

Winston-Salem/Forsyth County Schools, in cooperation with Forsyth County Government, has developed a website, forforsythteachers.com, with information to help voters make an informed decision on this ballot question.The site includes information about both the proposed tax and voting in the upcoming primary.

The ¼ cent sales tax adds one penny for every four dollars spent. The tax doesn’t apply to gas, groceries, prescription drugs, automobile purchases, rent and real estate transactions. Both Forsyth County commissioners and the WSFCS Board of Education have committed that revenue from the tax will go to teacher supplements.

If the sales tax passes, county commissioners will repeal a one-cent property tax increase in the current budget that brings in an estimated $3.6 million for teacher supplements. The ¼ sales tax is expected to bring in more than three times that amount.

It will be listed as “Forsyth County Sales and Use Tax” on the ballot. The primary election will be held March 3 and early voting is Feb. 13-29. This is a non-partisan issue that will appear on every ballot, no matter what party you’re in or if you’re unaffiliated.